Market View | Toledo Office – Overview

Hot Topics

- Statistically solid performance in the second half of 2021.

- Looming significant new vacancy arriving in 2022 suggests future struggles for the market.

- Operating cost increases driving up occupancy costs.

- The for-sale market was very active throughout 2021.

Overview

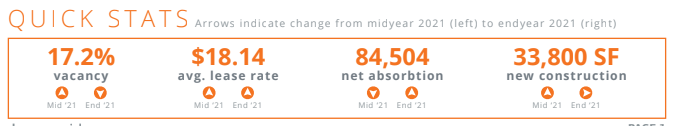

The end-year Reichle Klein Group survey of the Toledo, Ohio office space market found that, statistically, the market improved a bit from mid-year 2021 and from the end of 2020. The overall market vacancy rate declined from 18.3% to 17.24% over the last six months of 2021 as 84,504 square feet of space was absorbed. Meanwhile, the overall market average asking rental rate held at $18.14. Aiding the solid performance was leasing activity which picked up in the third and fourth quarters of the year, prior to the surge in COVID cases due to evolving strains of the virus that emerged late in the year. As this report is being written, it is uncertain as to whether this most recent surge will serve to slow activity again.

Interested in learning more?

Both landlords and tenants are struggling with costs. In the face of the oversupply of space, any landlord that might be inclined to offer lower rent to attract tenants is constrained by rapidly rising operating expenses, particularly utilities and janitorial expenses. Additionally, the cost of making tenant improvements is up drastically and continuing to rise so deals are difficult to pencil out without increasing occupancy cost simply to cover the cost of tenant improvements. Many tenants, on the other hand, are seeing increases in their occupancy costs in the form of operating expense pass-throughs. If a tenant goes to the market expecting to find alternatives and uses their leverage in a soft market to get a better deal, they are generally disappointed.

The real bright spot, and certainly the most surprising phenomenon of the pandemic era to date, has been the hot market for office buildings for sale. It seems counterintuitive and is not something that we foresaw nor can fully explain. But the pace of sales of smaller single-user and multi-user buildings purchased by buyers intending to occupy all or a part of the building continued at a torrid rate through the end of 2021. Most all these sales are occurring in suburban submarkets, though one high profile transaction of this nature did occur in the Central

Business District – the sale of the former United Way building to Lucas Metropolitan Housing. With the inventory of these buildings on the market shrinking significantly due to the activity of the last twelve to eighteen months, the pace of these transactions is likely to slow in the coming year.

However, there is this general sense of waiting for the other shoe to drop among our office specialists. This is based on our knowledge of several consequential moves and restructurings by occupiers of space that are in motion but not yet captured in the statistics. Several of these moves are non-COVID related but there are many vacancies that we know are coming that are directly related to COVID. There is also the sense that there are more that we don’t know of yet. A quick tally of those situations that are known to us amounts to over 300,000 square feet of additional vacancy that will officially hit the market in the coming year. Given the dynamics of the office-using segment of the Toledo economy and the post-COVID environment, it’s hard to see where the demand needed to backfill that vacancy is going to come from.

Both landlords and tenants are struggling with costs. In the face of the oversupply of space, any landlord that might be inclined to offer lower rent to attract tenants is constrained by rapidly rising operating expenses, particularly utilities and janitorial expenses. Additionally, the cost of making tenant improvements is up drastically and continuing to rise so deals are difficult to pencil out without increasing occupancy cost simply to cover the cost of tenant improvements. Many tenants, on the other hand, are seeing increases in their occupancy costs in the form of operating expense pass-throughs. If a tenant goes to the market expecting to find alternatives and uses their leverage in a soft market to get a better deal, they are generally disappointed.

The real bright spot, and certainly the most surprising phenomenon of the pandemic era to date, has been the hot market for office buildings for sale. It seems counterintuitive and is not something that we foresaw nor can fully explain. But the pace of sales of smaller single-user and multi-user buildings purchased by buyers intending to occupy all or a part of the building continued at a torrid rate through the end of 2021. Most all these sales are occurring in suburban submarkets, though one high-profile transaction of this nature did occur in the Central Business District – the sale of the former United Way building to Lucas Metropolitan Housing. With the inventory of these buildings on the market shrinking significantly due to the activity of the last twelve to eighteen months, the pace of these transactions is likely to slow in the coming year.

Interested in learning more?